VAT Return

VAT Return

Making Tax Digital (MTD) Ready and Compliant

Making Tax Digital (“MTD”) for VAT came into force on 1 April 2019 and became mandatory from 1 April 2022. For the vast majority of VAT-registered businesses with a taxable turnover above the VAT threshold (£85,000), it is mandatory to follow the MTD rules by keeping digital records and using software to submit their VAT returns.

Challenge

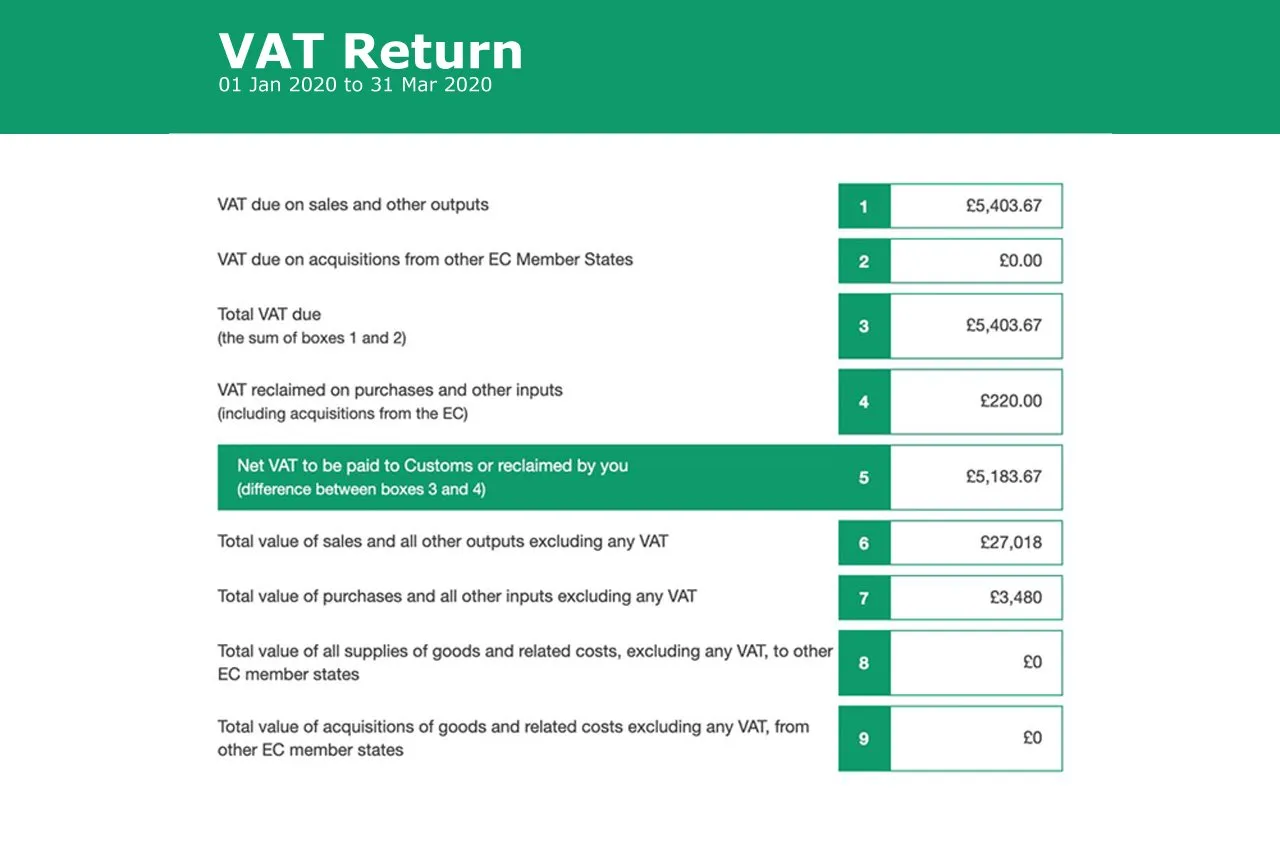

Value Added Tax (VAT) is the tax payable to HMRC on Sales of vatable Goods & Services provided less any VAT suffered on vatable purchases.

All businesses that exceed the annual VAT turnover threshold (£85,000 for 2022), must register for VAT and charge VAT on its sales. In addition, a Quarterly VAT return which is MTD compliant must be submitted to HMRC along with the VAT payable.

Description

VAT in UK is typically charged at 20% on goods and services sole, however certain goods and services (e.g. Children’s car seats, radiators etc) can have completely different VAT rates.

Businesses (that supply vatable goods or services) can also choose to voluntarily register for VAT. There are various benefits of being registered for VAT, as they can claim VAT suffered on purchases or some businesses can be in a VAT refund position.

VAT Schemes

We provide a full fledged service to help you register for the right VAT scheme with all the required documentation. Your dedicated account manager will discuss with you and assess which VAT scheme is best suited for your business. They will then get you registered for VAT and guide you all the way to raising your VAT invoices. The government has come up with various VAT schemes in order to match the conditions of different types of businesses.

- you pay a fixed rate of VAT to HMRC

- you keep the difference between what you charge your customers and pay to HMRC

- you cannot reclaim the VAT on your purchases – except for certain capital assets over £2,000

Note: To join the scheme your VAT turnover must be £150,000 or less (excluding VAT) for the 1st Year and not more than £230,000 (including VAT) from 2nd year onward, and you must apply to HMRC.

What our clients are saying about our service

Posted on